Pig Butchering Lawyer

'Pig-Butchering' Scams Cost Americans Billions. This Lawyer Is Taking Them On.

Prosecutor Erin West has been one of the few to have any success against the criminals perpetrating a new type of fraud

Santa Clara County Deputy District Attorney Erin West.

By Feliz Solomon

Photographs by Geloy Concepcion for WSJ

Sept. 17, 2024 10:00 am ET

In 2022, an unusual case came across the desk of Erin West, a California prosecutor who specializes in cybercrime. The victim was a 30-year-old man who thought he had met his soul mate on a dating app until he realized he had been conned out of $300,000. He was so ashamed that at times he was suicidal.

West and her investigative task force pulled off something of a miracle: They recovered about 70% of the man's money by tracing the funds to a wallet on a cryptocurrency exchange and then obtaining a warrant to freeze and seize it. It was the first time anyone was known to successfully claw back money stolen through a new type of fraud called "pig butchering," in which scammers build victims' trust and convince them to invest in bogus schemes.

Word spread fast. West was inundated by calls and emails from others who had been swindled by online scammers but didn't know how to get help. Some had gone to local police and were brushed off by officers, West said. Others reported what happened to U.S. government authorities but doing so never led anywhere, as far as they could tell. Some had never told anyone before, figuring it wasn't worth the embarrassment of admitting they had fallen for a love scam.

"There was a fire hose of victims," West recalled. "My inbox filled up with one tragic story after another."

That is how West became a magnet for victims of pig-butchering scams and law-enforcement officials who have been grappling with the problem. Independent researchers estimate that millions of people across the world have fallen victim to the scams, which siphon tens of billions of dollars to transnational crime syndicates each year.

The perfect crime

It works like this, investigators say: Gangs, run mainly by Chinese fugitives, set up criminal enclaves in places where law enforcement is weak, such as Myanmar, Cambodia and Laos. There they build industrial-scale compounds and fill them with people who sit at desks manning fake social media profiles. The profiles often appear to belong to beautiful young women who are financially independent but lonely. They seduce people online, convince them they are in love and then get them to pour money into bogus investments.

They are called pig-butchering scams because the swindlers "fatten" up their victims by building trust---over days, weeks, even months---then "butcher" them by taking the money and ghosting them. Some victims lose their life savings, families and even their will to live.

The scammers themselves are often also victims. The Wall Street Journal has reported how these gangs traffic people to the compounds and enslave them as fraudsters---a phenomenon the United Nations calls "forced criminality." The people are often job-seeking migrants lured by fake recruiters who promise them jobs in customer service or tech support. Upon arrival, they are picked up by traffickers who confiscate their passports and then are smuggled into compounds where they are threatened or tortured into compliance.

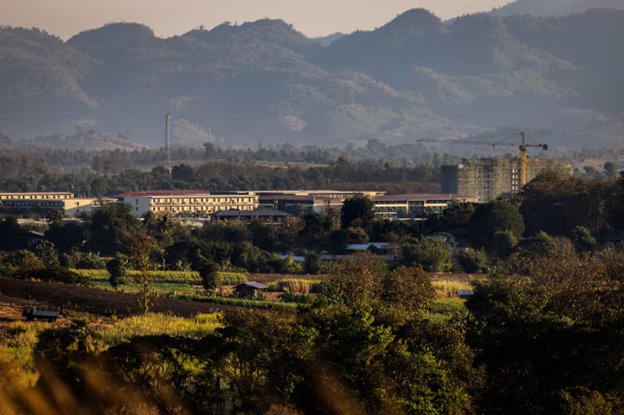

KK Park, a large industrial compound in Myanmar, is known for housing pig-butchering operations.

West didn't know all that when she took on the first case in 2022. But it didn't take long for her to realize the problem had spiraled out of control.

She started organizing meetings across the U.S. to share her expertise, including talks at local libraries and online tutorials on how digital assets work. Without ever really meaning to, West became the face of a nascent---some say quixotic---effort to stop the scams.

Often, the money moves too quickly through shell accounts to be frozen and becomes impossible to trace. Banks have brushed off responsibility because victims often willingly make the transfers. The transnational nature of the problem has posed jurisdictional challenges, with the scammers typically beyond the reach of the law.

"The problem is that we're extremely inefficient and the criminals are super efficient," said Silvija Krupena, director of financial intelligence at the consulting firm RedCompass Labs. She said the network of perpetrators is so diffuse and nimble that many people think there is little they can do about it, though often, there is.

Behind the curve

It was a bold leap for West when, in 2016, she joined an elite investigative task force focused on cybercrime. For the previous nine years, she had almost exclusively handled cases of sexual assault and hate crimes. But it took a toll on her mental health and she thought that working on online crimes would expose her to less trauma.

The Regional Enforcement Allied Computer Team based at the District Attorney's office in Santa Clara County, Calif., made a name for itself hunting down cybercriminals no one else could catch. West's first big case with the task force was the takedown of a ring in 2019 that hacked strangers' phones and siphoned cryptocurrency from their accounts. React sent five people to prison in a case that made the group a national authority on probing crypto crimes.

Erin West at a React task force conference in San Jose, Calif.

By 2022, U.S. authorities started noticing an uptick in online scams that followed pig-butchering patterns. The Federal Bureau of Investigation has urged victims to use an online internet crime complaint center, called IC3, to help collect data and build cases. It also set up another website to increase public awareness of crypto fraud.

But experts on law enforcement and transnational crime say the problem is too complex for any one nation or enforcement body to tackle alone. Lacking clear avenues for recourse, victims turn to whichever option they have heard about. Because of media attention following their 2022 success, West and React became the first port of call for many.

"We are way behind the curve," West said of global efforts to address the crisis. "We are not organized, we do not have a plan. There has to be a strategy."

The FBI said that while authorities have prosecuted cybercrimes, criminals are continually adapting, and it will continue working with global partners to address threats. The IC3 website says that because of the massive number of cases, it cannot respond directly to every complaint it receives, "but please know we take each report seriously."

Fighting back

So far, West and her team have clawed back some $3 million stolen from 26 Americans---a tiny fraction of the billions of dollars the FBI says are swindled from U.S. citizens each year.

West's task force quickly learned that cases had to meet three criteria to have any chance of success. Firstly, the transfers of money to the scammers had to have occurred on crypto exchanges, as some---but not all---do. Secondly, those exchanges had to be registered in the U.S., or cooperative with U.S. law enforcement. Third, the scam had to have been reported right away.

West knew from earlier crypto investigations that if she had the address of the wallet to which funds were transferred she could use a commercially available blockchain tracing tool to see where it went. If it was on a U.S.-based exchange, she could get a warrant to freeze and seize it. But if even a day or two has passed, the cryptocurrency may have already been converted to another asset, meaning the blockchain trail goes cold.

In the 2022 case that was West's first success, the coins were found in a wallet on Binance, an exchange that isn't licensed in the U.S. Despite being outside U.S. jurisdiction, the company complied with court orders and returned the money, West said.

Binance said it "goes above and beyond industry standards" to keep the crypto ecosystem free from bad actors.

Erin West and her team have recovered around $3 million stolen from 26 Americans.

'People have to start going to jail'

This year, West helped launch Operation Shamrock, a loose coalition of experts representing law enforcement, finance, civil society and tech giants such as Microsoft, Meta Platforms and LinkedIn. The idea is to get stakeholders into the same room to strengthen enforcement.

Earlier this month, the U.S. Treasury Department sanctioned a Cambodian politician and several business entities for alleged involvement in pig-butchering schemes.

But ultimately, she said, scams need to be cut off at the source by severing criminals' access to electricity and the internet.

"It really will require taking down these compounds," she said. "At some point, people have to start going to jail for this."

That is easier said than done since scammers operate in places where law enforcement is weak and corruption is rampant---problems that West has little influence over.

Jason Tower, Myanmar researcher for the U.S. Institute of Peace, a think tank founded by Congress, said the international response has been ad hoc, with authorities occasionally raiding pig-butchering compounds and nabbing money launderers but then moving on.

Tower said criminals bribe officials and invest in technology that puts them ahead of authorities, including generative AI tools, virtual currencies and satellite internet systems like Starlink.

"If it's ever going to stop," Tower said, "countries around the world will have to take this much, much more seriously."